Tag Archives: bulk auto note purchase

Santander debuts $1.3B revolving ABS

Residual value uncertainty bogs down Tesla lease ABS

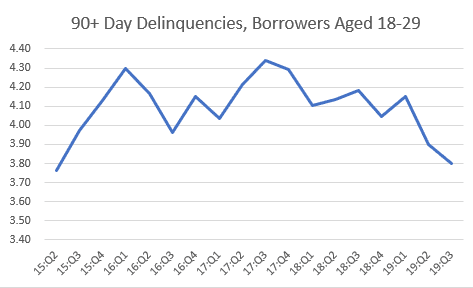

Serious delinquencies improve for young borrowers

Serious delinquencies — auto loans 90 days or more past due — for borrowers aged 18 to 29 years dropped 38 basis points to 3.8% year over year, marking this age group’s lowest delinquency level since 2Q15, according to the New York Federal Reserve’s third-quarter Report on Household Debt and Credit.

Percentage of borrowers aged 18 to 29 that transitioned to serious (90+ day) delinquency. Data from NY Federal Reserve and Experian

Though this age group’s serious delinquency level is the lowest its been in four years, the group still remains the segment with the highest rate of serious delinquency. Borrowers’ delinquency rates in their 30’s came in at 2.98%; 40’s at 2.32%; 50’s at 1.68%; 60’s at 1.41%; and 70+ at 1.75%.

Average delinquency rates across all age brackets came in at 2.34%, an increase of 4 basis points year over year.

Overall, total auto debt in the third quarter increased 3.9% year over year to $1.32 trillion.

Member satisfaction climbs after WSECU brings website design in-house

Since overhauling its online platform in April, Washington State Employees Credit Union (WSECU) members have reported a boost in user satisfaction.

“We do surveys of our members that have taken out loans and of members that have applied online, and we’re seeing that 90% of them are rating it as a low-effort experience,” said Ryan Brooks, director of digital lending at WSECU. “We have started to see our members tick up in their satisfaction around what they’re doing online.”

Prior to the site’s redesign, the Olympia, Wash.-based lender relied on third-party vendors to generate its digital presence. About three years ago, though, Brooks and his team changed the way they looked at the online member experience. “We really wanted our members to know more about us than just our name and the color palette,” he said.

Since then, WSECU brought many of its digital operations in-house to standardize the aesthetic and functionality across products and between devices. “Our lending experience and our website and our online banking all started to have the same look and feel, all the way down to behaviors,” Brooks said.

“If you have 50 different vendor solutions, the navigation bar is never going to be in the same place, so little things like that where our progress bars are consistent, the primary calls to action are consistent, the secondary calls to action are consistent,” he explained. “You start to build those patterns with members so that when they go into an experience that I believe has a lot of anxiety around it — like in lending — and it’s not a new experience.”

Since the April launch, WSECU has built workflows and processes around the core platform, Brooks said. One example is the preapproval workflow implemented in June. “It basically pops up and says, ‘Hey, you’re preapproved for this product. If you’d like to accept this, click here,’ and it bypasses all the application process that the member would normally have to go through,” he said.

Nicholas Financial maps growth trajectory

Porsche Financial expands insurance coverage to EVs

Porsche Financial Services has expanded its car insurance coverage to include services related to electric mobility, the company announced. The service, called “E-Cover,” was designed to supplement the upcoming release of the Porsche Taycan Turbo, the German automaker’s first all-electric vehicle.

Consumers in Germany will be able to add coverage to an existing insurance policy that is specifically designed for electric vehicles, including original price coverage of the battery in the event of damage, charging station insurance and protection for e-mobility-specific components, such as the electric outlet.

E-Cover is also available for the plug-in hybrid models of the Cayenne and Panamera models.

Read more: Porsche Financial Services Pilots Auto Insurance Program

The all-wheel drive Taycan Turbo and Taycan Turbo S models are set to debut in 2020. The four-door coupe will reach 62 mph in 2.8 seconds and will boast a 350-mile range with system voltage of 800 volts — double the standard on electric vehicles in production.

In addition, the Taycan will be able to charge to 80% in just over five minutes if connected to a high-powered charging station that uses a direct current. Porsche plans to release “less powerful variants” of the Taycan later in the year and invest more than $6.7 billion in electric mobility by 2022, according to a company release.