Tag Archives: sell bhph notes

KBRA Withdraws Ratings as Honor Finance Securitization Winds Down

Honor Finance’s 2016 securitization has been withdrawn from Kroll Bond Rating Agency’s surveillance after being paid in full, the rating agency announced this week.

The transaction had suffered two downgrades since July 2018, a month before the defunct company transferred its servicing to Westlake Portfolio Management. On June 17, servicer Westlake Portfolio Management exercised its right to redeem the notes in full, paying down the remaining Class B and C tranches when the outstanding balance of loans fell below 20% of their original amounts, the press release said.

Also read: Despite Stronger May, ABS Credit Performance Likely to ‘Deteriorate,’ Rating Agency Says

The B and C notes, which had been downgraded in April, had balances of $7.2 million and $8.8 million, respectively, at the time. Based on an April 25 report, cumulative net losses in the tranches had increased to 31.2% from 29.4%; the rating agency had predicted the Class C notes would incur as much as an $8 million loss on the $8.8 million principal.

KBRA withdrew its rating on the class A tranche in December 2018 after the notes were paid in full, according to past agency reports.

Off-Lease Vehicles Boost Used-Car Prices

Stricter leasing terms are propping up the used-vehicle market, according to Edmunds’ first-quarter Used Vehicle Report.

Average used-vehicle prices hit a record-breaking high of $20,247, compared with $19,700 in the same prior-year period. Edmunds’ research attributes the increase partially to “the return [to market] of a record volume of vehicles leased in 2016,” the report noted.

Average mileage on used vehicles dropped to 51,000, compared with 60,500 in 2013, mostly due to tighter mileage allotments on leasing contracts. Vehicles returning to market have, overall, less wear and tear — two out of three used vehicles sold in the market are four years old or newer, the report said.

In fact, used-vehicle prices have increased 17.4% in the past five years. By comparison, new-vehicle prices increased 14.7% in that same time period.

In addition, these off-lease vehicles sport features rarely seen in the used-vehicle market before — such as Bluetooth capabilities, backup cameras, and keyless ignition — which further bolster vehicle prices and tighten the gap between new- and used-vehicle prices.

In addition, SUVs continue to retain their popularity, commanding 48% of sales in the first quarter. SUVs also have better residual values compared with the rest of the market, which also boost average prices, the report noted.

Weakening Credit Spurs Santander Downgrade

Dealer Group CFO Admits to Defrauding Ford Credit of $50M

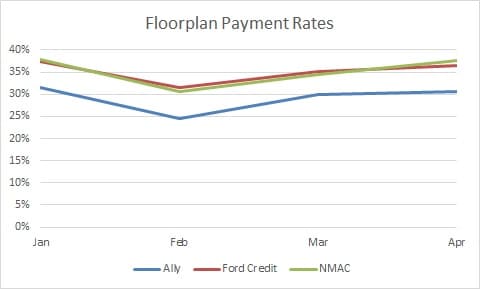

Slowing Inventory Turnover Reduces Floorplan ABS Payment Rates

As vehicles idle on dealers’ lots, auto lenders face slower repayment of their floorplan loans.

Nissan Motor Acceptance Corp., for one, has been in breach of a floorplan trigger since February, when its three-month payment rate dropped below 35%. As such, NMAC had to increase credit enhancement levels in its floorplan trust.

Ally Financial, Ford Motor Credit, GM Financial and Mercedes-Benz Financial Services also have seen floorplan payment rates decline. MBFS posted the biggest decline — 14.9 percentage points year over year — to 40.7% as of March 31, according to a new report from Moody’s. MBFS’s payment rate trigger is 37.5%.

Ally’s floorplan payment rate dropped 4.3 percentage points to 28.7%. Ally has a three-tier trigger, the highest of which is 25%. Meanwhile, Ford Credit’s average payment rate fell 3.5 percentage points to 34.7%, nearly 10 percentage points higher than its 25% trigger. And GM’s payment rate declined 1.9 percentage points to 42.2%. It, too, has a three-tiered trigger, the highest of which is 25%.

Typically, dealers reduce inventory as vehicle sales slow, thereby bumping up payment rates. For instance, in the previous recession, ABS floorplan payment rates increased 6.5 percentage points from the fourth quarter of 2018 to the first quarter of 2019, according to the Moody’s report. That increase came despite a 12% decline in new-vehicle sales.

NMAC’s monthly payment rate already is edging up. It gained 3 percentage points in May to 37.6%, according to Securities and Exchange Commission filings. Should June’s payment rate come in at a similar level, the captive will once again be in compliance with its floorplan trigger.

Seasonality also is working in floorplan lenders’ favor, as vehicle sales tend to tick up in the second and third quarters, said Nick Monzillo, the Moody’s analyst who authored the report.

Among the lenders tracked by Moody’s, Hyundai Capital America was the only one whose monthly payment rate increased year over year. The rate improved 1.1 percentage points to 40.7%. While Monzillo could not attribute the higher payment rate to any specific factor, he noted that payment rates could vary based on sales incentives.

Here’s a summary of floorplan payment rates for Ally, Ford Credit, and NMAC, based on SEC filings:

Auto Outstandings Grow 30% YOY at 5 Largest Credit Unions

Auto outstandings at the nation’s five largest credit unions increased year over year, totaling $32.5 billion last year compared with $25.2 billion in 2017, according to Big Wheels Auto Finance Data 2019.

No. 1-ranked Navy Federal Credit Union notched a 10.3% increase last year in its auto portfolio, to $13.9 billion. Among the nation’s top 100 auto financiers, NFCU was ranked 20th, edging out Citizens One Auto Finance and Southeast Toyota Finance.

However, originations plunged 55.7% to $3.4 billion in 2018. NFCU told AFN late last year that an origination slowdown is likely to continue through yearend 2019.

In the No. 2 spot, San Antonio, Texas-based Security Service Federal Credit Union grew outstandings to $5 billion, compared with $4.7 billion the year prior. Moreover, originations increased 15.7% year over year, to $2.2 billion.

Meanwhile, Sacramento, Calif.-based Golden 1 Credit Union took third place, cultivating volume growth of 6.6% year over year — increasing its portfolio to $4.8 billion. Originations increased 4.1% to $2.5 billion.

America First Credit Union jumped in rankings to the No. 4 spot with a 21.6% increase in its portfolio, reaching $4.5 billion and surpassing Alaska USA Federal Credit Union, which fell to the No. 5 spot with 2.3% growth to $4.3 billion outstanding.

Senators Urge Regulatory Oversight of AI to Prevent Discrimination

Online Retail Platform Shift Adds Prime Options With TD Auto, U.S. Bank

Carvana Hits ABS Market With Second Transaction

Carvana is bringing $337.3 million in asset-backed securities to market in a deal that’s expected to close June 27, according to a presale report by Moody’s Investors Service issued this week.

Carvana’s second deal of the year props up its ABS volume to $676.1 million just three months after the online used-vehicle retailer completed its inaugural securitization. Mostly subprime retail auto loans back Carvana’s latest transaction, and the pool consist of 18,787 auto loan contracts originated by Carvana and serviced by Bridgecrest Credit, a subsidiary of DriveTime Automotive Group.

Compared with Carvana’s March securitization, the new deal shows a Fico score increase to 636, one point higher than the previous transaction. The weighted loan-to-value ratio decreased to 96% compared with 99%. Meanwhile, the weighted average APR increased “slightly” to 13.84% compared with 13.47% during the last deal, Moody’s notes.

Average loan term of 70 months remains similar to the last transaction, and Texas, Georgia, and Florida still hold as the top three states for geographic distribution.

As for Carvana’s managed portfolio’s net losses, the portfolio’s 30-plus-day delinquencies as a percentage of the month-end receivables balance as of March 31 were 4.7%, up from 3.8% during the same time last year. Net losses as a percent of average principal outstanding remained flat at 0.7%.

Moody’s credit loss expectation is 11% because the loan contracts backing the transaction skew toward subprime borrowers, the presale report notes. However, Moody’s highlighted the strength of Bridgecrest Credit to help mitigate potential losses.

“Bridgecrest Credit has more than 20 years of experience servicing nonprime auto loans and has a servicing portfolio of approximately $7 billion,” Moody’s notes. “It handles roughly $400 million payment collections each year.”