Tag Archives: sell bhph notes

Westlake Calls on Dealers to Use Automated Payoff Tool Amid Recent Success

Flagship Credit Acceptance Settles $4M TCPA Claim

Auto Finance Innovation Summit Delves Into Analytics-Enabled Tech

Nagesh Jaladi, Vice President, Applied Predictive Technologies, Mastercard

Nagesh Jaladi, vice president of applied predictive technologies at Mastercard, has joined the speaker faculty at Auto Finance Innovation Summit to share how lenders can successfully leverage and evolve analytic capabilities.

Jaladi will offer insights into how captive and non-captive lenders are innovating through analytics, best practices for overcoming organizational and operational constraints to try new approaches, and how can small lenders keep up with larger peers on analytic capabilities. Jaladi’s presentation will take place on May 14 at 9:45 a.m. PT.

Jaladi leads the global auto practice for Mastercard, delivering technology and analytical capabilities to help organizations innovate, grow, and stay ahead of the competition in today’s digital world.

Developments in machine learning, subscription services, and blockchain are spurring lenders to rethink and refine their operations. The 4th Annual Auto Finance Innovation Summit, a part of the week-long event Auto Finance Accelerate, will explore what innovations have true importance to the industry, and how those technologies can be refashioned to break auto finance’s mold.

Join us for two days of sessions featuring executives from financial institutions and cutting-edge startups at this year’s event, which will be held at the Omni San Diego on May 14-15, directly following the Auto Finance Sales & Marketing Summit. Check out the full agenda here.

As the industry’s news source, Auto Finance News is dedicated to uncovering technology disruption and how companies are investing in innovation. The event will feature sessions including making sense of fintech regulation; practical applications for machine learning; and more.

To learn more — or to register — for this year’s event, visit the Auto Finance Accelerate homepage here.

Why the Auto Finance Industry Needs a Greater Focus on Digital Sales & Marketing

Most sales and marketing job ads go something like this:

As an Inside Sales Relationship Manager, you will be contacting Auto Dealerships to sign up with AUTO FINANCE COMPANY NAME HERE as one of their sub-prime lenders. … The expectations for the first year at this job is to be making $60k – $100k per year. We have an amazing building with a built-in gym and break areas. Our environment is that of a positive sales floor with great competition to bring out your best. Auto industry experience is helpful but NOT required.

The problem is this ad hearkens to the old way of doing auto finance sales and marketing: pound the dealer, score some credit apps, repeat at the next dealership.

Auto finance sales and marketing needs to change, yet too many in the industry don’t realize it. We’re presenting the Auto Finance Sales & Marketing Summit to help with the transition.

The transition relates to how auto loans are originated.

But, first, to the market dynamics. Car sales have been poised for softening for at least a year, and whether the market truly recedes or not, auto lenders should expect a time when credit applications do not flow regardless of the sales rep.

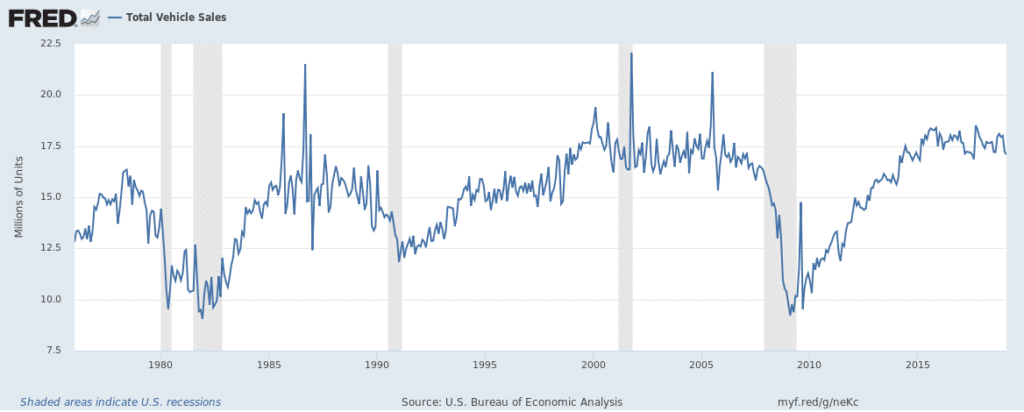

Source: Federal Reserve Bank of St. Louis

As the chart above illustrates, we are years into a significant expansion in car sales. The car market contracts with regularity: in the early 1980s, the early 1990s, and after the credit crisis. The data implies that the car market may undergo a sustained decline. Your sales and marketing operation should be ready for it.

But for what? An auto finance company can hire sales rep after rep to bolster its volume. But the market is changing — and sales reps are not the fount of originations they once were.

Auto Finance News conducted a survey of 200 consumers this month to find out just how significant is the digital originations channel today. About 65% of consumers are open to securing their auto loans online, with about 26% of them significantly inclined to do so. Today, around two-thirds of consumers finance their car purchases, so the numbers are significant — +10 million new vehicles in 2019.

Our survey also found that most consumers are shopping for cars online. For example, 54% of consumers will check out automobile enthusiast websites like Edmunds, Motor Trend, or CarAndDriver.com before making a purchase. The test drive is still crucial to consumers — 61% called it “extremely important” to the car-buying process — but vehicle marketing is an online game.

Here’s how consultancy BCG put it last August:

The growth of mobile devices, e-commerce, and social media has changed the ways people shop. Today, when consumers research products ahead of a purchase, they are likely to look beyond traditional information sources to new forms of guidance and recommendations, including social media and social media influencers. When they are ready to buy—whether it’s a dinner, a sweater, or a vacation—they expect services that make shopping convenient and fast, owing to their interactions with e-commerce giants such as Amazon and Alibaba. Consumers’ twin expectations of efficient service and instant gratification are now spilling over into their views about buying bigger-ticket items, including cars.

With that in mind, vehicle financing needs to be a digital game. More than 19% of respondents called the financing options the “most important” factor when purchasing a car — if the purchasing is happening online, so too must the financing.

As such, Auto Finance News is presenting the Auto Finance Sales & Marketing Summit. The Summit will explore how to respond to these changing dynamics. For example, we will investigate what “digital experience” means in auto finance; what new value propositions are needed; what technology can support your digital marketing; how expectations around customer service are changing; why there is no such thing as an alternative to omni-channel today; and how to analyze performance for improved digital results.

We expect that attendees will change how they view sales and marketing — to the point where that on-site gym access will be less of a benefit than previously thought.

Sierra Auto Finance Unloads Servicing Portfolio

Bank of America, HCA Join Speaker Faculty at Auto Finance Sales & Marketing Summit

The discussion will take place on Monday, May 13, at 3:15 p.m. PT at the Omni San Diego. The panel will feature an open dialogue between Duane Freeman, senior vice president of consumer vehicle lending and national sales executive at Bank of America, and John Thacker, national sales director at Hyundai Capital America.

The auto finance market is rapidly evolving as consumer preferences change, marketing technology evolves, and smartphones threaten traditional sales strategies. The panelists will discuss these trends and offer best practices addressing unconventional ways to structure, train, and manage the salesforce while creating a seamless handoff from smartphone to dealership.

Produced by Auto Finance News and Royal Media, the Auto Finance Sales & Marketing Summit will also consist of one-on-one chats with top executives, as well as presentations and panel discussions with industry thought leaders. The full Auto Finance Sales & Marketing Summit agenda can be found here.

Participants will gain insights into new ways of measuring sales rep performance, developing a direct lending marketing strategy, technologies to improve marketing efficiencies, and more. Additional topics for discussion will include managing the modern “martech” landscape; how the “Amazon effect” changes customer service strategies; the latest on marketing analytics to boost sales and efficiency, and more.

To learn more about the Auto Finance Sales and Marketing Summit visit SalesandMarketingSummit.com.

Auto Finance Sales and Marketing Summit is part of the weeklong Auto Finance Accelerate event series. Join us for this event, plus Auto Finance Innovation Summit and Auto Finance Risk Summit, May 13-16, 2019. Visit AutoFinanceAccelerate.com for full details. Team registration is available. For more information or to register contact events@royalmedia.com.