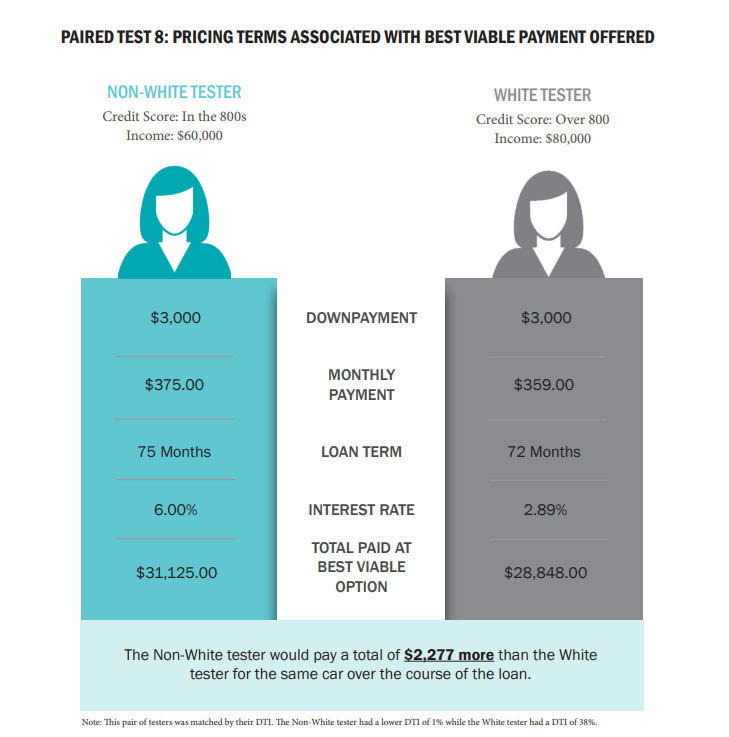

On Wednesday, April 17th, the U.S. Senate completed a 15 minute roll call vote on the motion to proceed with S.J.Res.57, a joint resolution providing for Congressional disapproval of the rule submitted by the Consumer Financial Protection Bureau (CFPB) relating to “Indirect Auto Lending and Compliance with the Equal Credit Opportunity Act”. Weeding through the challenging language, essentially this means the Senate will proceed with debate to backtrack on one of the key precepts of the CFPB – guidance restricting how auto loans can be presented to consumers.

The original intent of the CFPB’s rule was to limit racial discrimination during the auto lending process by forcing lenders to cap how much dealerships are allowed to markup interest rates on approved loans. However, many feel the rule was simply a restatement of existing laws already in force under the Equal Credit Opportunity Act (ECOA). And while new CFPB acting Director Michael Mulvaney appears to be de-fanging the organization, many are left scratching their heads on the topic of compliance in auto lending.

Regardless of how this debate ends, compliance is alive and well in the auto lending industry. There are numerous other local, state, and federal regulations which are firmly in place. For example, at the state level, each state has a comprehensive list of regulations touching on Lemon Laws, addressing misleading advertising, warranty agreements, pricing, documentation fees, and more. Minding these regulations is imperative, especially since they are carefully monitored by Motor Vehicle boards and state Attorneys General who hold the power to suspend dealership licenses and fine lenders.

At the federal level, the Federal Trade Commission serves as one of the lead regulatory entities for the auto industry. Other regulations include the Patriot Act, Equal Credit Opportunity Act, and the Fair and Accurate Credit Transactions Act.

While compliance regulations continue to place a burden on loan portfolios, lenders can take steps to off-set the repercussions by offering complimentary consumer protection products, like vehicle service contracts and vehicle return protection policies. This gives lenders the ultimate control over product compliance.

Offering complimentary consumer protection products also provides lenders the potential to protect loan portfolios from the risk of default and delinquency in the event of a vehicle breakdown or job loss by reducing the financial burden on consumers and enabling them to either keep making their loan payments, or return the vehicle with no damage to their credit.

As compliance costs and vehicle prices rise, lenders need more tools than APR and loan terms to manage look-to-book goals and loss ratios. Adding complimentary consumer protection products to their tool belt opens the door to increased non-interest-bearing income and enhanced compliance control.

Administrators such as EFG Companies can bring you up to date on how to achieve compliant profitability in the auto lending space. Fortify your business with EFG and contact us today.